Money Saving Hacks That Actually Work in 2026

Saving money in 2026 doesn’t mean giving up your favorite latte or living in the dark. It means being strategic, smart, and a little savvy. Whether you’re just starting your budgeting journey or trying to improve your cash flow, there are real, practical hacks that can make a meaningful difference. Let’s dive into the money-saving strategies that actually work—no gimmicks, just results.

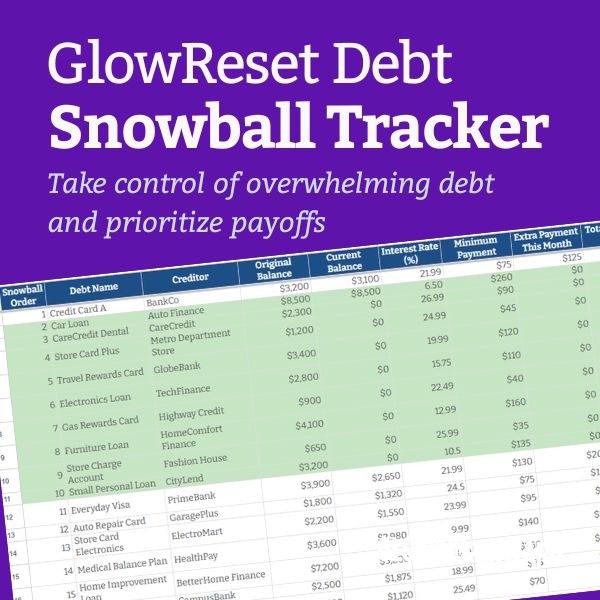

Build a Budget That Works for You

Budgeting is the foundation of financial health. Without a clear plan, it’s easy to lose track of where your money goes. But the good news? Budgeting tools in 2026 are smarter and more intuitive than ever.

Start with the 50/30/20 Rule

50% for Needs: Rent, groceries, bills.

30% for Wants: Dining out, entertainment.

20% for Savings: Emergency fund, investments, debt payoff.

This method gives you structure while allowing flexibility. It’s especially helpful if you’re new to budgeting and want a simple way to start.

Use Budgeting Apps to Stay on Track

Apps like Monarch, YNAB (You Need a Budget), and Rocket Money offer real-time tracking, savings goal settings, and even subscription management. Most connect directly to your bank accounts, so you can see your spending patterns at a glance.

Pro tip: Set up alerts for when you go over budget in any category. It’s a gentle reminder that helps you course-correct quickly.

Automate Your Savings

One of the easiest ways to save money is to remove temptation. Automation does that beautifully.

Set Up Auto-Transfers

Schedule automatic transfers from your checking account to a high-yield savings account each payday. Even $25 a week adds up to $1,300 a year—without lifting a finger.

Use Round-Up Apps

Apps like Acorns and Qapital round up your purchases to the nearest dollar and save or invest the difference. It’s passive saving that grows over time.

Cut Recurring Costs Without Sacrificing Joy

Saving doesn’t have to feel like punishment. In fact, trimming recurring expenses can free up cash flow without making life dull.

Audit Your Subscriptions

Streaming services, fitness apps, premium newsletters—they add up. Use an app like Rocket Money to identify unused subscriptions and cancel with one tap.

Negotiate Bills Automatically

Services like Billshark and Trim negotiate lower rates for your internet, phone, and insurance bills. They often charge a percentage of what they save you, so there’s no upfront cost.

Switch to Annual Billing

Many apps and platforms offer a discount when you pay annually instead of monthly. If your budget allows, switching can save you 10–30% each year.

Be Smart with Everyday Spending

Little changes in your day-to-day spending can lead to big savings. It’s not about deprivation—it’s about strategy.

Plan Your Meals and Groceries

Make a meal plan for the week.

Create a grocery list based on that plan—and stick to it.

Shop with cash or a prepaid card to avoid impulse buys.

Bonus hack: Try grocery delivery through a store that waives fees if you spend a minimum. It’s easier to avoid impulse purchases when you shop online.

Use Cashback and Reward Apps

Apps like Rakuten, Fetch, and Upside give you cash back on everything from gas to groceries. Link your cards once and let the savings roll in.

Combine these with store loyalty programs to double up on rewards.

Increase Your Cash Flow Creatively

Sometimes, saving money isn’t enough—you need to bring more in. Here’s how to boost your cash flow without burning out.

Sell What You Don’t Use

Decluttering isn’t just good for your space—it’s good for your wallet. Use platforms like Facebook Marketplace, Poshmark, or eBay to sell clothes, gadgets, and furniture you no longer need.

Tap Into the Gig Economy

Have a skill or passion? Offer it on Fiverr, Upwork, or TaskRabbit. Whether it’s writing, design, tutoring, or assembling IKEA furniture—there’s a market for it.

Put Your Money to Work

High-yield savings accounts, CDs, and robo-advisors like Betterment or Wealthfront can help your money grow passively. Even a few extra dollars earned in interest each month can help pad your savings.

Final Thoughts: Make It a Habit, Not a Hassle

Saving money in 2026 isn’t about luck—it’s about intention. With smart budgeting, the right apps, and a few well-placed habits, you can manage your cash flow confidently and build a future you’re excited about.

Start with one hack today. Track your progress weekly. Celebrate small wins. Because financial freedom isn’t a finish line—it’s a lifestyle. And you’re ready for it.