How to Build Wealth on a Modest Salary (Without Sacrifice)

Think building wealth requires a six-figure salary or extreme frugality? Think again. With the right strategy, you can grow your net worth steadily—even on a modest income—without giving up everything you love. Whether you're earning $35K or $65K, smart investing and intentional planning can set you on a path to financial freedom.

Start with a Clear Plan

Wealth building doesn’t happen by accident. The first step is knowing where you want to go and how you’ll get there. Set specific financial goals: Do you want to buy a home, build a retirement fund, or invest in real estate? Once your goals are clear, your strategy becomes easier to map out.

Track Your Spending

Before you can grow your money, you need to know where it’s going. Track every dollar for at least one month. Use a budgeting app or spreadsheet to categorize your spending. You’ll likely find small leaks—subscriptions you forgot about or takeout habits that add up—that can be redirected toward wealth building.

Automate Your Savings

Pay yourself first. Set up automatic transfers to your savings and investment accounts immediately after payday. Even if it’s just $50 a month, consistency over time makes a big impact thanks to compound growth.

Invest Early and Often

You don’t need to be a stock market expert to start investing. In fact, the best strategies are often the simplest. The goal is to let your money grow over time so you’re not relying solely on your paycheck.

Why Index Funds Work

Index funds are a smart, low-cost way to invest. They track a broad market index, like the S&P 500, giving you instant diversification. You don’t have to pick winning stocks—just ride the market’s long-term growth. Plus, they usually have lower fees than actively managed funds.

- Start with a Roth IRA or traditional IRA if your employer doesn’t offer a 401(k).

- If you do have a 401(k), contribute enough to get the company match—it’s free money.

- Use a robo-advisor or brokerage account to invest in index funds monthly.

Even on a modest salary, investing $100–$200 a month can grow into six figures over a few decades.

Use Real Estate to Build Wealth

Real estate isn’t just for the wealthy. With the right approach, it can be a powerful tool for building passive income and long-term value.

House Hacking

Consider buying a duplex or triplex and living in one unit while renting out the others. The rental income can help cover your mortgage, reduce your living expenses, and start building equity—without big sacrifices.

REITs for Beginners

If buying property isn’t in the cards right now, Real Estate Investment Trusts (REITs) are a great way to invest in real estate through the stock market. Many index funds include REITs, or you can invest in them directly through a brokerage account.

Keep Lifestyle Inflation in Check

As your income grows, it’s tempting to upgrade your lifestyle. But if you increase spending every time you get a raise, it’s hard to build wealth.

Instead, try this: Every time you get a raise, put at least half of it toward your investments or savings. You’ll still enjoy some lifestyle upgrades, but you’ll also accelerate your financial goals.

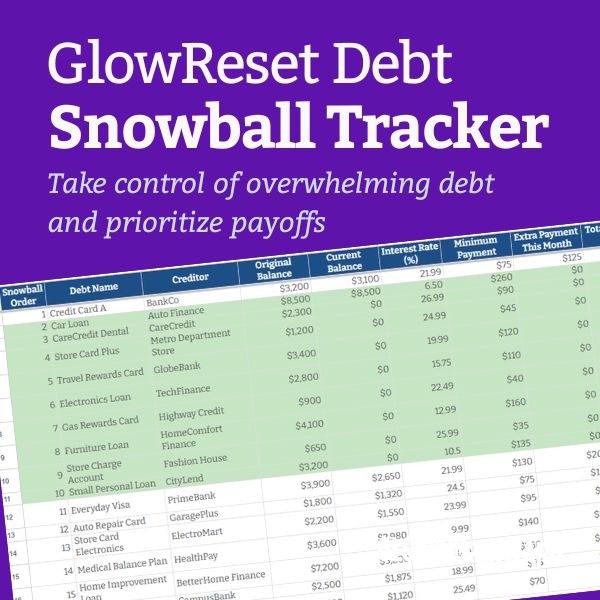

Use Debt Strategically

Not all debt is bad. Some, like student loans or mortgages, can help you build long-term value. But high-interest consumer debt, like credit cards, can sabotage your wealth-building efforts.

- Pay off high-interest debt as quickly as possible.

- Refinance or consolidate if it helps lower your interest rate.

- Use credit only when it supports your long-term plan—not for impulse buys.

Stay the Course

Building wealth on a modest salary takes time, but it’s absolutely possible. The key is consistency. Keep investing, avoid lifestyle creep, and make smart financial choices even when it’s tempting to splurge.

You don’t need a massive paycheck to grow your net worth. With smart investing, steady contributions to index funds, and maybe a little real estate on the side, you can build real wealth—without giving up your daily coffee or the occasional weekend getaway. Stay focused, stay strategic, and your future self will thank you.